Why Sponsored Products Alone Could Kill Your Amazon Business in 2026

- Amazon Growth Lab

- Dec 27, 2025

- 8 min read

If your entire Amazon advertising strategy is Sponsored Products campaigns, you're missing significant opportunities and likely experiencing rising costs as competition intensifies.

Most sellers still run 70-90% of ad spend through Amazon Sponsored Products. While this worked well in 2019-2021 when competition was lower, the landscape has shifted substantially.

At Amazon Growth Lab, after managing $100M+ in Amazon sales, here's what we've observed: The advertisers achieving the strongest results aren't just optimizing Sponsored Product ads better. They're using full-funnel advertising strategies backed by Amazon Marketing Cloud (AMC) attribution.

The Structural Challenge with Sponsored Products Only

Sponsored Product ads capture existing intent at the bottom of the funnel. When someone searches "stainless steel water bottle," they already know what they want.

They're comparing options. They're ready to convert.

This is valuable traffic. It's also increasingly expensive.

Here's why: You're competing with thousands of sellers for the same high-intent searches. When many sellers bid on identical keywords, CPCs rise. More bidders competing for fixed inventory means higher prices.

Amazon Sponsored Products offer no audience building, no brand awareness, no customer journey management. You're not creating demand. You're competing for existing demand.

The result: Rising ACoS that's difficult to control through optimization alone. You can refine bids, add negative keywords, adjust match types - all valuable tactical improvements. But you're still in the same auction with competitors bidding up the same keywords.

What Changed in 2024-2025

The Amazon advertising landscape shifted in the past 18 months:

Ad Inventory Shifts

Based on our analysis across client accounts, we've observed that Sponsored Products appear to have less prominent placement in many high-visibility positions, with Amazon featuring video placements, Sponsored Brand positions, and Sponsored Display inventory more prominently.

This pattern - reduced prominence for traditional Sponsored Product ads in some placements - means more competition for remaining spots.

Performance Patterns Across Ad Formats

Based on our observation across client accounts, brands running diverse ad campaigns often achieve better overall results than those focused solely on Sponsored Products.

Brands utilizing multiple ad formats frequently report improved reach and efficiency - a pattern we've observed consistently across accounts managing $100M+ in Amazon sales.

Upper-Funnel Invisibility

Brands running SP-only strategies are invisible in upper-funnel customer experiences. When potential customers browse Amazon, watch streaming content, or explore categories, they never see your brand. They only encounter you at the final purchase decision - when they're comparing you against competitors who built brand awareness earlier.

The Full-Funnel Approach

Sophisticated Amazon advertisers in 2025 operate across three funnel stages:

Upper-Funnel: Awareness & Discovery

Sponsored TV / Connected TV (CTV)

Builds brand awareness among Amazon's streaming audience. These ads appear on Fire TV, IMDb TV, and Amazon's streaming properties.

Performance: Based on our client accounts, brands typically see search lift within 7-30 days. Typical costs: $25-45 CPM, though this varies significantly by category and season.

Purpose: Create demand rather than just capture existing demand.

Streaming TV Ads

Amazon's streaming TV inventory offers closed-loop attribution through Amazon Marketing Cloud (AMC). You can measure how streaming TV exposure translates to Amazon searches, product page visits, and purchases.

Mid-Funnel: Consideration & Engagement

Sponsored Brands Video

Appears in search results and often delivers stronger engagement than static Amazon Sponsored Product ads in our client accounts. Video format allows storytelling and product demonstrations.

Purpose: Convert awareness into active consideration.

Sponsored Display

Builds retargeting audiences at competitive costs. Reach customers who viewed your products, competitor products, or match specific demographic profiles.

Purpose: Nurture awareness into consideration through repeated exposure.

Lower-Funnel: Conversion

Sponsored Products (Properly Positioned)

Amazon Sponsored Products remain essential - but as one component of a comprehensive strategy.

In a properly structured full-funnel strategy, Sponsored Product campaigns typically represent 35-50% of total ad spend, not 90%. Their role: Convert existing intent efficiently, especially for customers already aware of your brand.

Together, these three funnel stages create a comprehensive customer acquisition system. Upper-funnel builds awareness, mid-funnel nurtures consideration, lower-funnel converts intent - each stage potentially reducing advertising cost and improving efficiency.

The Mindset Shift Required

The transition requires fundamental mindset shifts:

Old Model: "Run ads → get immediate sales → measure ROAS"

Every dollar must generate immediate attributable revenue. Success means positive last-click ROAS.

New Model: "Build audiences → nurture through funnel → convert and retarget"

Some advertising builds awareness without immediate conversion. Success means customer acquisition cost across the entire journey, not just last-click efficiency.

Stop Thinking in Campaigns; Start Thinking in Customer Journeys

Campaign-centric: "My Sponsored Product campaign has 28% ACoS."

Journey-centric: "Customers who see our CTV ad search for our brand at higher rates.

Those brand searches convert at better rates with lower ACoS. The CTV spend may pay for itself through brand search efficiency even though CTV has limited direct last-click attribution."

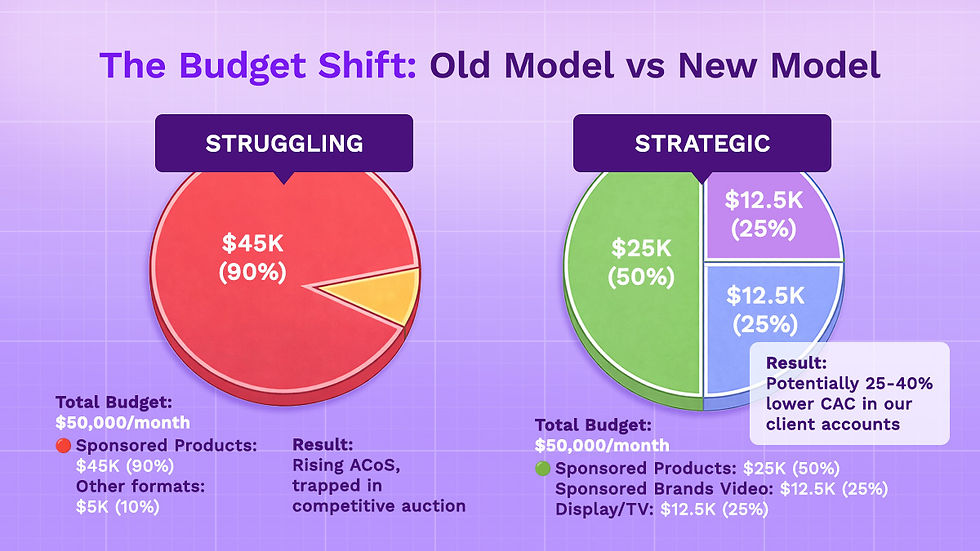

Example: A $50,000/month budget might shift from $45K Sponsored Products + $5K other formats to $25K Sponsored Products + $15K Sponsored Brands Video + $10K Display/TV. Total spend is unchanged, but CAC may decrease.

Amazon Marketing Cloud Reveals Multi-Touch Attribution

Amazon Marketing Cloud allows attribution modeling that reveals how upper and mid-funnel advertising contributes to lower-funnel conversions. Without AMC, you only see last-click attribution, which systematically undervalues awareness advertising.

With AMC, you can measure: How many customers saw your Sponsored TV ad, then searched for your brand, then clicked a Sponsored Product ad, then purchased.

Last-click attribution gives 100% credit to the Sponsored Product. AMC reveals the Sponsored TV ad initiated the sequence.

The Evidence: What Happens When Brands Diversify

Results from brands making this transition in our client portfolio.

Brands shifting from 90% Sponsored Products to 50% SP + 30% Sponsored Brands Video + 20% Display/TV in our client base report:

Reduced Customer Acquisition Cost

When measured through AMC rather than last-click, total customer acquisition cost often decreases. In our client accounts, we've seen CAC reductions of 25-40%, though results vary significantly by category and execution.

Improved New-to-Brand Percentage

Full-funnel strategies attract customers who've never purchased from your brand. We typically see 30-50% improvement in New-to-Brand percentage in our client accounts.

Better ROAS When Measured via AMC

Last-click attribution understates ROAS from diversified strategies. AMC reveals stronger returns.

Example: One client's Sponsored TV investment appeared to deliver 0.8:1 ROAS on last-click basis. AMC analysis revealed 3.2:1 ROAS when accounting for downstream brand searches and conversions. These are specific client results, not market-wide norms.

The Operational Reality: What Full-Funnel Requires

This isn't just "turn on more ad types." Full-funnel requires operational capabilities:

Video Creative Production

Sponsored Brands Video, Sponsored TV, and streaming ads require ongoing video content. Successful brands produce 4-8 new video assets monthly.

Video production costs typically range from $500-$5,000 per asset. Budget $2,000-$10,000 monthly for video creative.

Amazon Marketing Cloud (AMC) Understanding

Proper attribution requires AMC implementation and analysis. This means SQL queries, data analysis capabilities, and understanding of multi-touch attribution models.

Budget Reallocation Based on Funnel Contribution

You must allocate budget based on funnel contribution, not just last-click ROAS. This requires leadership buy-in to invest in ads without immediate directly-attributed returns.

Willingness to Invest in Awareness

Spending money on advertising that builds brand awareness without immediate purchase attribution requires sophisticated measurement, executive buy-in, and patience to see results across 30-90 day windows.

At Amazon Growth Lab, we handle these operational components - video production coordination, AMC implementation, and strategic budget allocation.

Warning Signs You're Behind

Check how many warning signs describe your strategy:

70%+ of ad spend in Sponsored Products - Most budget in the most expensive, competitive auction

No video creative - Locked out of high-performing ad formats

Measuring success purely on last-click ROAS - Systematically undervalues awareness advertising

ACoS climbing despite optimization - Experiencing the structural challenge

Agency only manages Sponsored Products - Using outdated playbooks

The Key Insight

Amazon Sponsored Products aren't dead - they're one piece of the puzzle. Treating them as your entire strategy means competing only at the bottom of the funnel.

The shift: Consider controlling more of the entire journey.

Build awareness so customers search for your brand specifically. When customers search "YourBrand water bottle" instead of "stainless steel water bottle," you're not competing against thousands of sellers.

Nurture consideration so customers recognize your brand from previous exposures. Familiarity drives clicks and conversions.

Convert efficiently with Sponsored Product ads because you've done the work higher up to make conversion easier and less expensive.

What Percentage of Your Amazon Ad Spend Is in Sponsored Products?

If it's over 70%, you may be experiencing rising costs and declining efficiency.

What's stopping you from diversifying? Lack of video creatives? No AMC capability? Agency limitations? Budget constraints?

At Amazon Growth Lab, we help brands transition from Sponsored Products-only strategies to full-funnel Amazon advertising. Schedule a consultation to discuss your specific situation.

Frequently Asked Questions

How much should I allocate to upper-funnel advertising?

Start with 15-20% of total ad spend on upper and mid-funnel formats. Monitor brand search lift and New-to-Brand percentage increases.

Successful implementations in our client accounts typically scale to 40-50% upper/mid-funnel within 6-12 months.

Can smaller brands afford full-funnel advertising?

Full-funnel works at different scales. Brands spending $10K+/month on Sponsored Products can begin testing Sponsored Brands video ($2K/month) and Sponsored Display ($1K/month).

Sponsored TV typically requires larger budgets ($5K+/month minimum).

How do I measure success if not using last-click ROAS?

Focus on blended metrics: total Customer Acquisition Cost, New-to-Brand percentage, brand search lift, and overall business profitability (TACoS).

Amazon Marketing Cloud provides multi-touch attribution. Measure success across 60-90 day windows.

What video content performs best?

Product demonstrations showing the item in use, problem-solution narratives, and comparison content highlighting advantages.

Videos should be 15-30 seconds, mobile-optimized, with captions. Test 4-6 creative variants monthly. Focus on the first 3 seconds.

Do I need an agency for full-funnel advertising?

Full-funnel requires capabilities most sellers lack: video production, AMC analysis, multi-format campaign management, and attribution modeling.

At Amazon Growth Lab, brands attempting DIY full-funnel often struggle with measurement and optimization. The operational complexity typically exceeds internal capabilities.

How long does it take to see results?

Upper-funnel results (brand search lift) can appear within 7-30 days. Mid-funnel engagement improvements may show within 30-60 days. Lower-funnel efficiency gains typically emerge within 60-90 days.

Most brands in our portfolio see meaningful CAC improvements by month 3 and substantial improvements by month 6.

Will diversifying hurt my sales initially?

Budget reallocation can cause temporary sales dips as you shift spend from direct-response Sponsored Products to awareness-building formats.

In our experience, brands often see 10-20% sales reduction in weeks 2-4, recovering by week 6-8. Gradual reallocation (5-10% monthly) minimizes disruption.

What's the biggest mistake brands make?

Measuring upper-funnel formats on last-click ROAS and concluding they "don't work."

Sponsored TV might show 0.5:1 ROAS on last-click while actually driving stronger ROAS when properly attributed through AMC. Without correct measurement, brands abandon effective strategies.

How do I optimize my product listing before scaling?

Before investing heavily, ensure your product listing converts:

High-quality images, compelling bullet points

A+ Content showcasing your brand story

25+ reviews with 4.3+ star average

Competitive pricing

Improve conversion rate first, then scale advertising.

What's the difference between Sponsored Display and Amazon DSP?

Sponsored Display: Self-service display advertising managed through Seller Central. Good for retargeting. Budget-friendly ($500+/month).

Amazon DSP: Programmatic display requiring higher budgets (typically $10K+/month) and more sophisticated targeting.

Most sellers should start with Sponsored Display.

At Amazon Growth Lab, we help brands transition from Sponsored Products-only strategies to full-funnel Amazon advertising. Schedule a consultation to discuss your specific situation.

Disclaimer: The strategies and performance metrics in this article are based on patterns observed across our client accounts. They are illustrative examples from our portfolio and do not guarantee specific results for any advertiser; individual outcomes vary significantly based on product category, competition, creative execution, and market conditions.

Comments